Best insurance rates in NC sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Exploring the factors, types of insurance available, tips for finding the best rates, and competitive insurance companies in North Carolina will provide a comprehensive guide for those seeking affordable coverage.

Factors Affecting Insurance Rates in North Carolina: Best Insurance Rates In Nc

Insurance rates in North Carolina are influenced by several key factors that individuals should consider when shopping for coverage. Demographics, driving record, location, credit score, and coverage options all play a significant role in determining insurance premiums.

Demographics

Demographic factors such as age, gender, marital status, and occupation can impact insurance rates. For example, younger drivers typically face higher premiums due to their lack of driving experience.

Driving Record, Best insurance rates in nc

A clean driving record with no accidents or traffic violations can result in lower insurance rates. On the other hand, a history of accidents or speeding tickets may lead to increased premiums.

Location

The location where you reside can also affect your insurance rates. Urban areas with higher rates of accidents and theft may result in higher premiums compared to rural areas.

Credit Score and Coverage Options

Maintaining a good credit score can help lower insurance rates. Additionally, the type and amount of coverage you choose will impact your premiums. Opting for comprehensive coverage or adding additional riders to your policy may increase costs.

Types of Insurance Available in North Carolina

North Carolina offers various types of insurance policies to meet the needs of residents. Auto, home, health, and life insurance are among the most common options available.

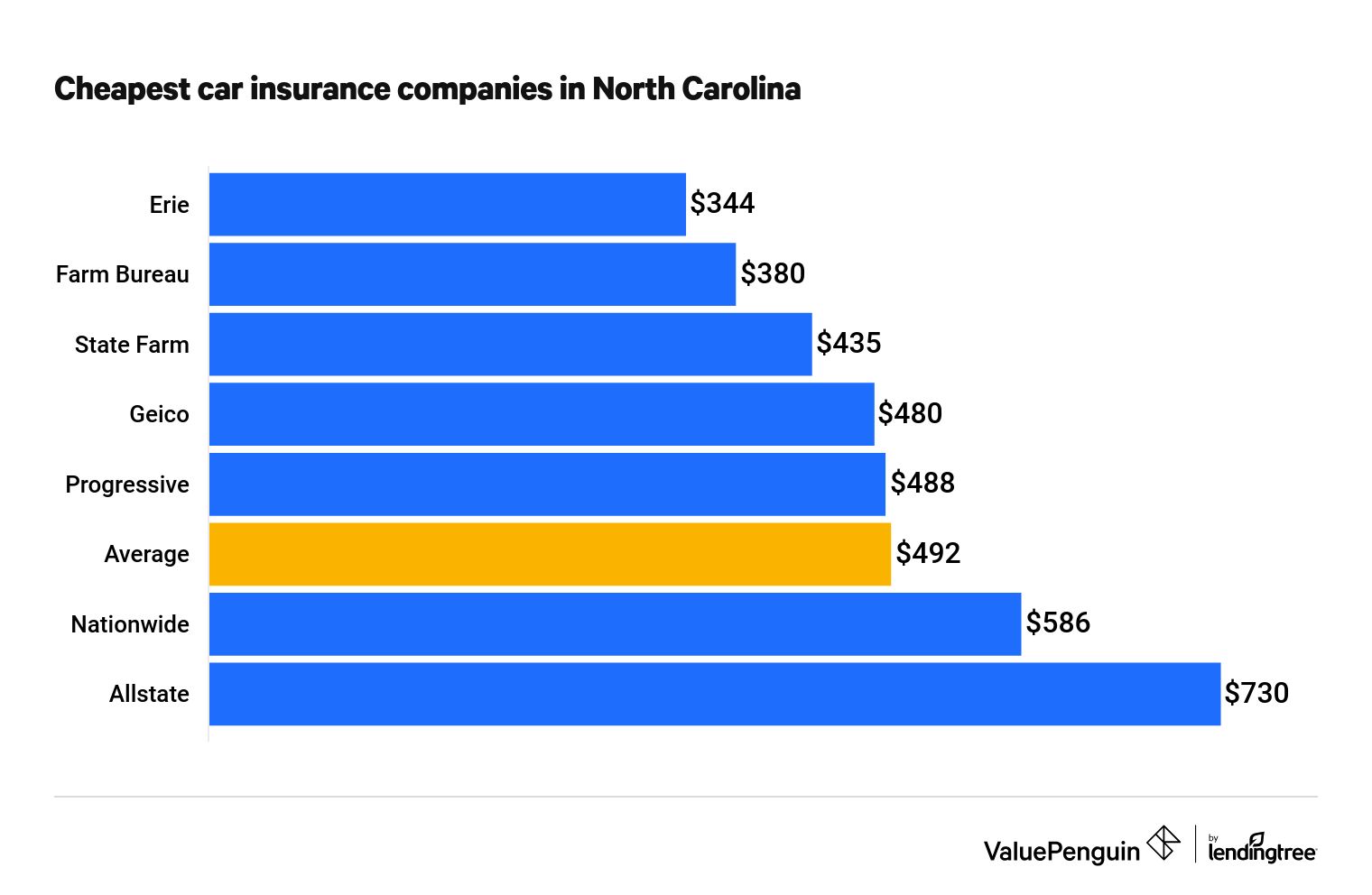

Auto Insurance

Auto insurance provides coverage for vehicles in case of accidents, theft, or damage. Liability coverage is required in North Carolina, and additional options like collision and comprehensive coverage are available.

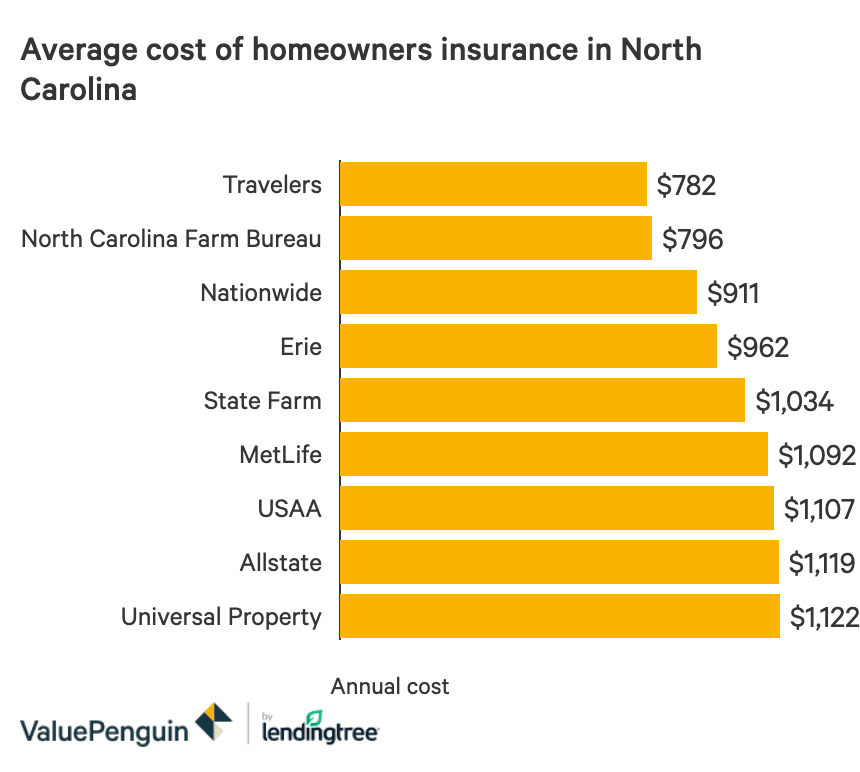

Home Insurance

Home insurance protects against damage or loss to your property and belongings. Policies can cover events such as fire, theft, and natural disasters, providing financial security for homeowners.

Health Insurance

Health insurance helps cover medical expenses and healthcare services. Individuals can choose from various plans, including HMOs, PPOs, and high-deductible health plans, depending on their needs.

Life Insurance

Life insurance provides financial protection for loved ones in the event of the policyholder’s death. Term life, whole life, and universal life are common types of life insurance policies available in North Carolina.

Tips for Finding the Best Insurance Rates in NC

When searching for insurance in North Carolina, consider the following tips to secure the best rates and coverage options.

Research and Compare Rates

Take the time to research different insurance providers and compare quotes to find the most competitive rates. Online comparison tools can help streamline this process.

Leverage Discounts and Incentives

Many insurance companies offer discounts for factors such as safe driving, bundling policies, or maintaining a good credit score. Take advantage of these incentives to lower your premiums.

Review Policy Coverage Limits

Make sure to review the coverage limits and deductibles of your policy. Adjusting these amounts can impact your premiums and ensure you have adequate protection.

Insurance Companies with Competitive Rates in North Carolina

Several insurance companies in North Carolina are known for offering competitive rates and quality service to policyholders.

Top Insurance Providers

Some of the top insurance providers in North Carolina include State Farm, Geico, Progressive, and Allstate. These companies have strong financial ratings and positive customer reviews.

Local and Regional Insurers

Local and regional insurance companies may also provide unique advantages for North Carolina residents. These insurers may offer personalized service, local expertise, and tailored coverage options.

Ending Remarks

In conclusion, navigating the world of insurance rates in North Carolina doesn’t have to be daunting. By understanding the key factors, exploring different types of insurance, implementing smart tips, and choosing reputable insurance companies, you can secure the best coverage at the most competitive rates. Stay informed, compare options, and make the best choice for your insurance needs.

FAQ Explained

What are some unique factors that can influence insurance rates in North Carolina?

Factors such as local weather patterns, crime rates in specific areas, and regional traffic congestion can impact insurance rates in NC.

Is it possible to negotiate insurance rates with providers in North Carolina?

While insurance rates are largely based on statistical data and risk assessment, some providers may offer discounts or customized plans based on individual circumstances.

How can I ensure I’m getting the best insurance rates in North Carolina?

Researching multiple providers, comparing quotes, bundling policies, maintaining a good credit score, and reviewing coverage options regularly can help you secure the best insurance rates in NC.