Car insurance lawsuit, a legal battleground often fraught with complexities and uncertainties, delves into the intricacies of insurance disputes, coverage denials, and legal ramifications.

As we navigate through the nuances of different types of car insurance lawsuits, the legal process involved, and the factors influencing outcomes, a clearer picture emerges of the challenges and resolutions in this realm.

Overview of Car Insurance Lawsuit

Car insurance lawsuit is a legal action taken by individuals against their insurance company to resolve disputes related to coverage, claims, or compensation. Common reasons for car insurance lawsuits include denial of claims, disputes over liability, bad faith practices by insurance companies, and disagreements over coverage limits. Typical outcomes of car insurance lawsuits may result in settlements, compensation for damages, or court judgments.

Types of Car Insurance Lawsuits

- Liability Disputes: These lawsuits revolve around determining who is at fault in an accident and the extent of liability for damages.

- Bad Faith Claims: These lawsuits involve allegations that the insurance company acted in bad faith, such as denying valid claims or delaying payments without justification.

- Coverage Denials: These lawsuits are filed when an insurance company refuses to provide coverage for a claim based on policy terms or other reasons.

High-profile car insurance lawsuit cases include disputes over coverage for accidents involving celebrities, disputes over policy interpretation in complex insurance contracts, and claims of bad faith practices by large insurance corporations.

Legal Process of Filing a Car Insurance Lawsuit

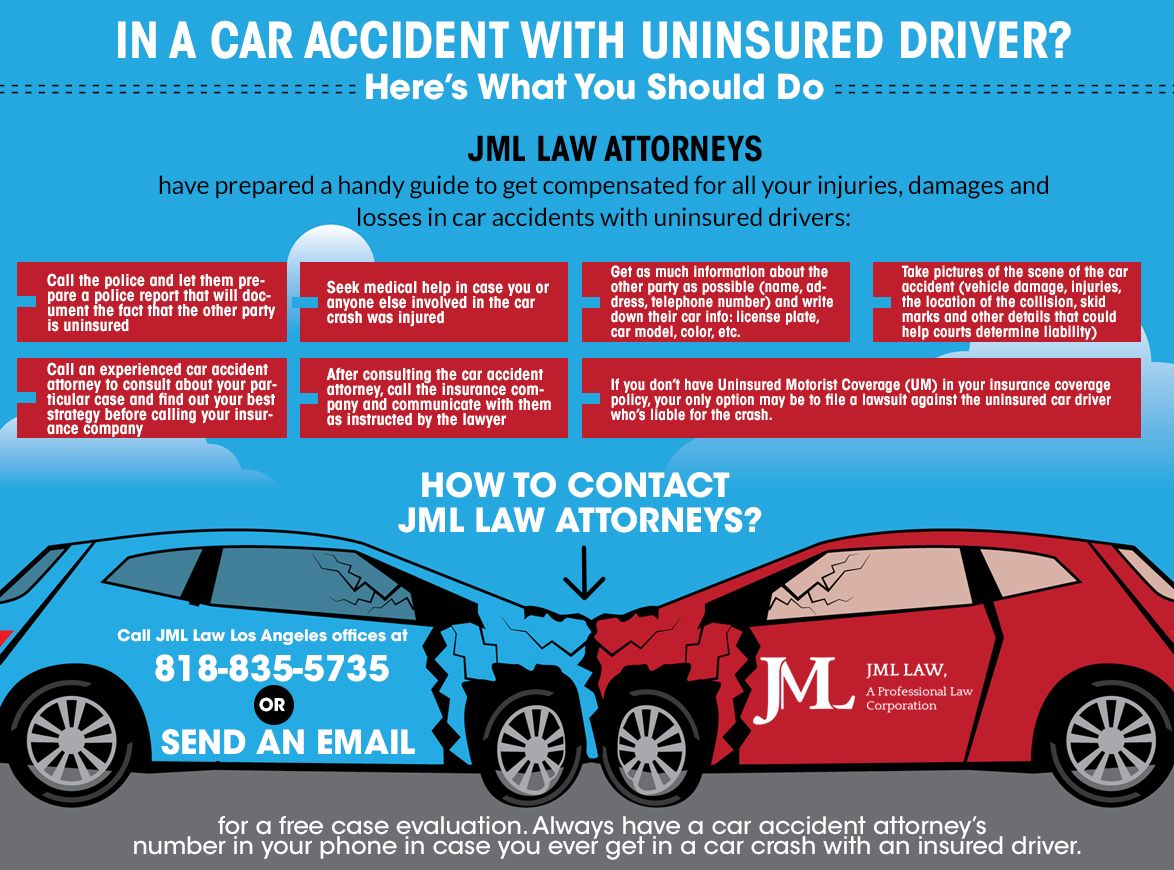

Filing a car insurance lawsuit involves several steps, including gathering evidence, submitting a claim to the insurance company, negotiating a settlement, and potentially going to court if an agreement cannot be reached. Documentation required to initiate a car insurance lawsuit may include police reports, medical records, repair estimates, and correspondence with the insurance company. Legal representation plays a crucial role in guiding individuals through the legal process, advocating for their rights, and ensuring fair compensation.

Factors Influencing Car Insurance Lawsuit Outcomes

- Fault Determination: The determination of fault in a car insurance lawsuit can significantly impact the outcome, as it affects liability and compensation for damages.

- Policy Coverage Limits: The coverage limits defined in an insurance policy can restrict the amount of compensation available in a lawsuit, influencing settlement negotiations and court judgments.

- State Laws: State laws governing insurance regulations and practices play a critical role in shaping the resolution of car insurance lawsuits, impacting the legal standards, procedures, and outcomes.

End of Discussion

Car insurance lawsuits encapsulate a dynamic interplay of legal procedures, insurance intricacies, and judicial decisions that shape the outcomes of these contentious cases. Understanding the legal landscape and complexities involved is crucial for navigating through the complexities of car insurance disputes.

FAQ Guide

What are some common reasons for filing a car insurance lawsuit?

Common reasons include disputes over liability, bad faith claims by insurance companies, and denials of coverage.

How does fault determination influence car insurance lawsuit outcomes?

Fault determination plays a critical role in deciding liability and the eventual settlement or judgment in a car insurance lawsuit.

What documentation is required to initiate a car insurance lawsuit?

Documentation such as accident reports, medical records, insurance policies, and correspondence with the insurance company is typically required.

What role does legal representation play in a car insurance lawsuit?

Legal representation is vital in navigating the complexities of the legal system, negotiating with insurance companies, and advocating for the rights of the claimant.